Customer data management for utilities

How important is reliable data for the industry?

Exploding gas and electricity prices, looming shortages, climate levies, government-imposed electricity and gas price brakes, energy flat rates, network fees - regulations without end. Smart meters must be rolled out, IS-U expires by the end of 2030. Optimized data helps with these tasks.

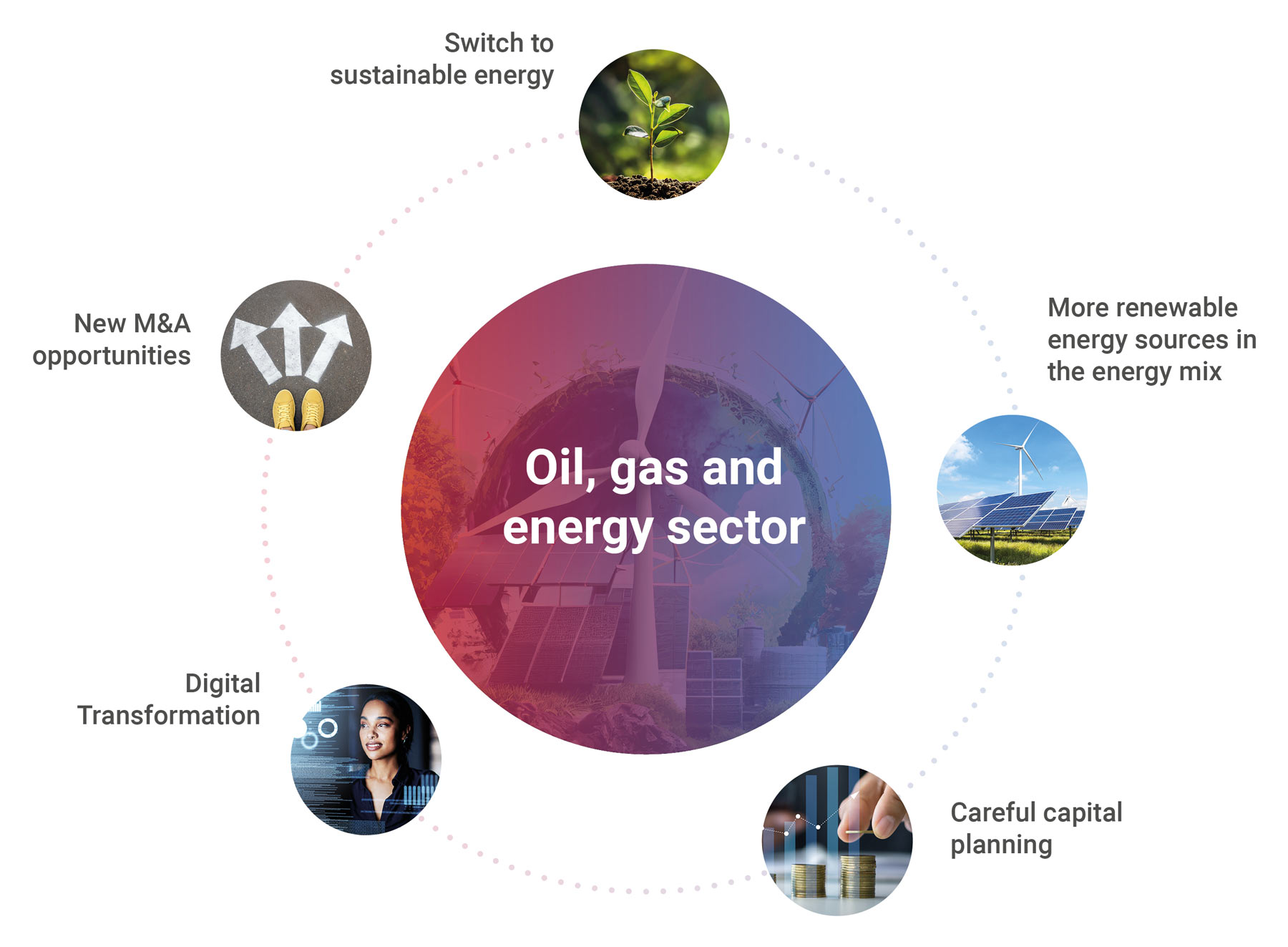

It quickly becomes clear that energy suppliers are confronted with a wealth of different tasks and challenges. There is hardly any time to deal with the quality and management of customer data. And yet this is so important. After all, reliable data opens up a great deal of potential for developments in different directions, for example with new, digital business models. High-quality data with optimized business processes ensure stability, orientation and free capacities.